Construction Loans

For Ground-Up Development

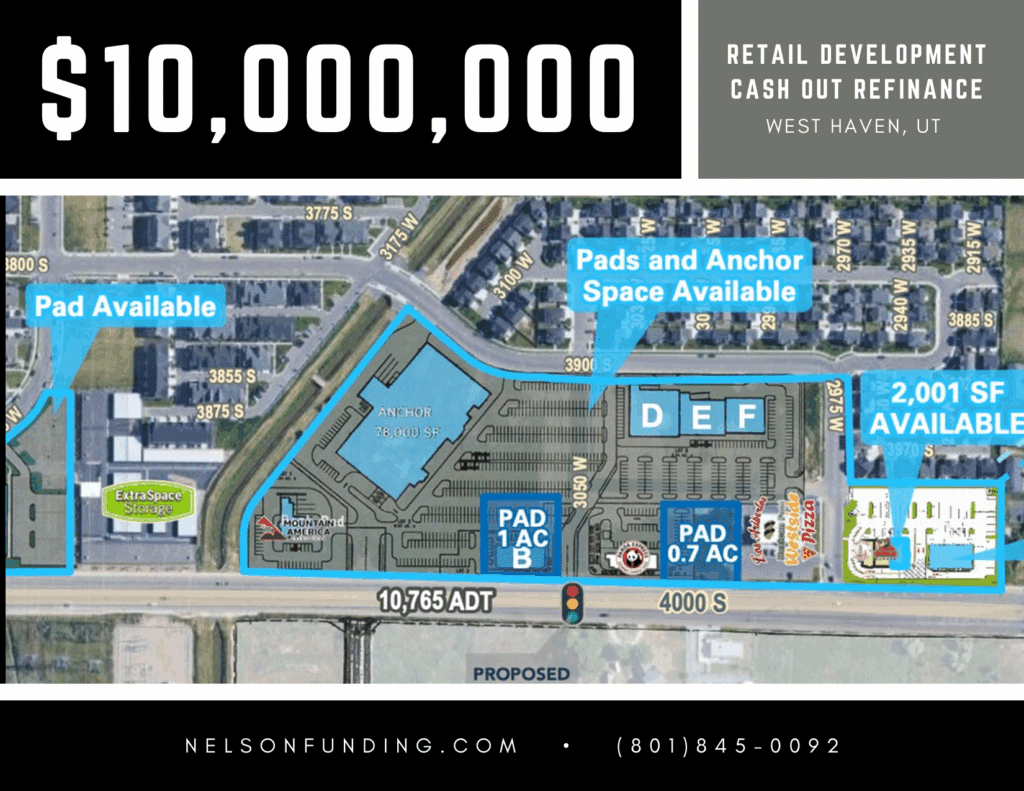

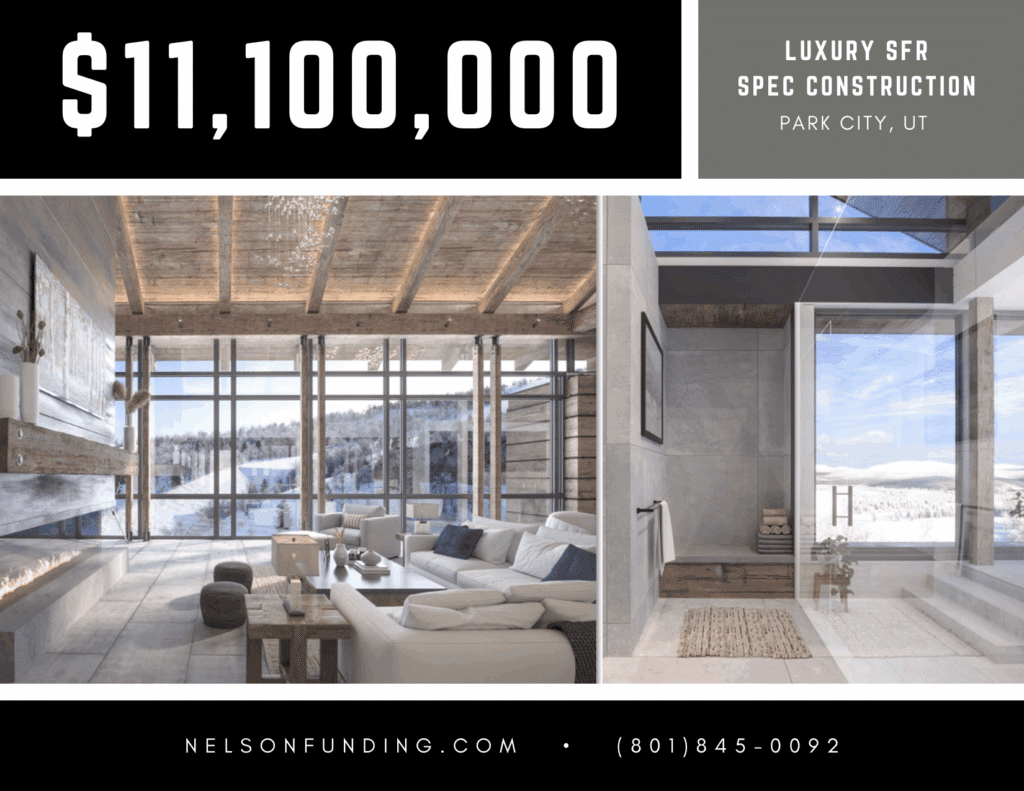

New construction financing for commercial projects across Utah's high-growth markets. Utah's development pipeline remains active despite national headwinds. We fund multifamily projects in Draper, Herriman, and Eagle Mountain, office buildings serving the Silicon Slopes tech corridor, industrial warehouses in West Valley City and West Jordan, retail centers in master-planned communities, and mixed-use developments in downtown Salt Lake City and Sugar House. Our construction loan program includes interest-only payments during the building phase, flexible draw schedules matching contractor milestones, loan amounts from $2 million to over $100 million, and the ability to finance projects where banks require excessive pre-leasing or equity contributions. Common projects include workforce housing developments targeting Utah's growing population, tech campus buildouts in Lehi and Draper, industrial facilities serving e-commerce distribution, and hospitality assets in Park City and St. George.